Nationwide Insurance Review (2025)

- What makes Nationwide a trusted pet insurance provider? Nationwide is one of the longest-standing and most recognized names in pet insurance, offering coverage since 1982. As the first company to provide pet health insurance in the U.S., Nationwide has built a reputation for reliability, comprehensive coverage, and a commitment to pet wellness. With a broad network and strong financial backing, pet owners trust Nationwide to protect their pets’ health.

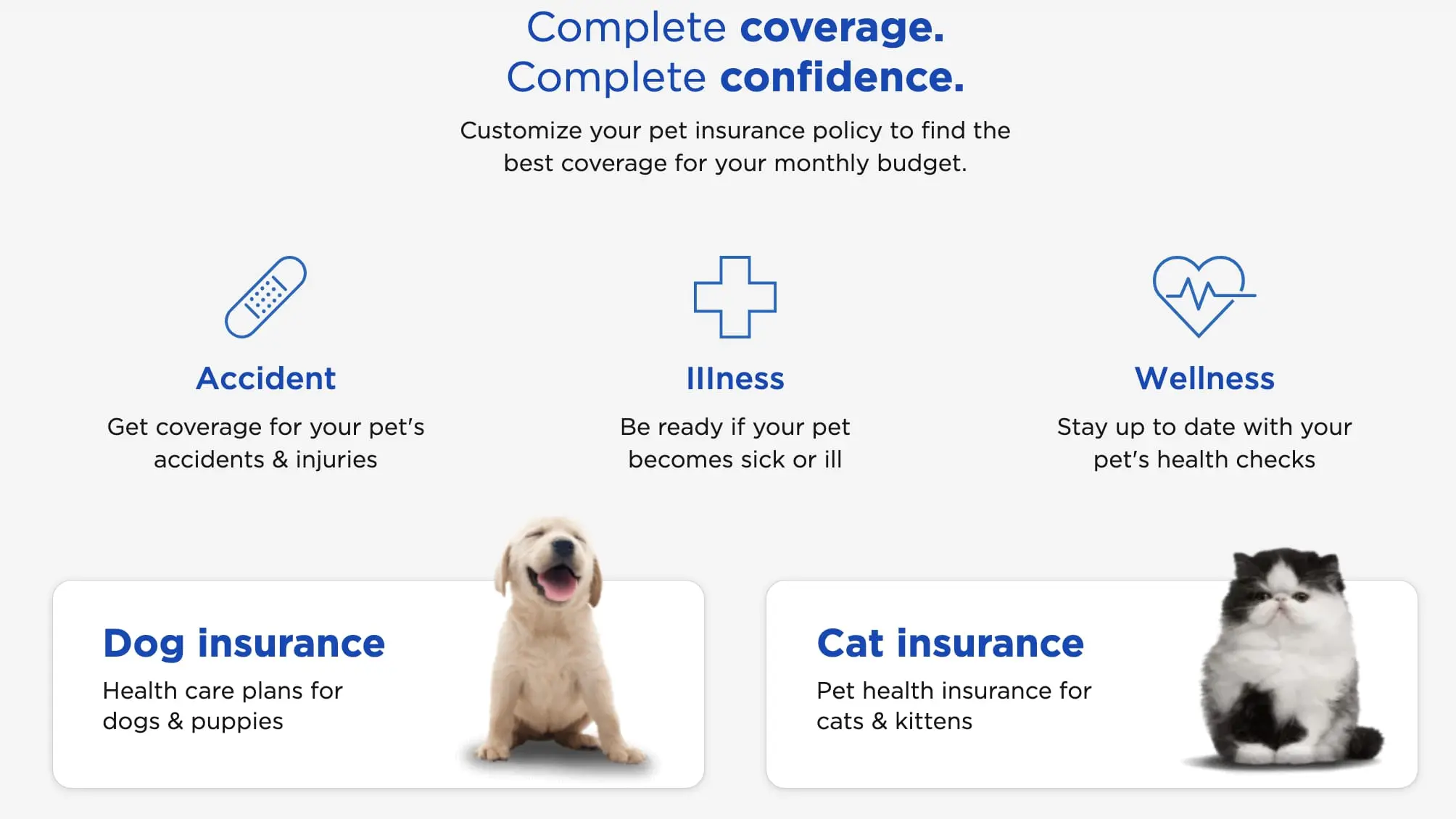

- What types of coverage and treatments does Nationwide offer? Nationwide provides various coverage options, including plans for accidents, illnesses, hereditary conditions, and even wellness care. Their Whole Pet with Wellness plan covers diagnostics, surgeries, chronic conditions, and routine care like vaccinations and flea prevention. They also offer accident-only plans and coverage for exotic pets, making them a unique option in the pet insurance industry.

- How flexible are Nationwide’s plans and pricing?Nationwide offers different levels of coverage to fit various budgets and pet care needs. Pet owners can choose from comprehensive plans with wellness coverage or more basic accident-only policies. While pricing varies based on the pet’s breed, age, and location, Nationwide provides policyholders with multiple deductible and reimbursement options to customize their plans.

- How easy is it to submit a claim with Nationwide? Nationwide allows pet owners to submit claims through an online portal or mobile app, streamlining the reimbursement process. While claim processing times may vary, policyholders can expect payments within a few weeks. Their customer service team is available to assist with questions, ensuring a hassle-free experience for pet owners.

When it comes to ensuring the health and well-being of your beloved pet, choosing the right insurance provider is a crucial decision. Nationwide Pet Insurance is one of the leading pet insurance providers in the United States, offering a variety of plans to cover everything from routine checkups to emergency surgeries. Unlike many competitors, Nationwide extends its coverage beyond just dogs and cats to include birds, reptiles, and other exotic pets. But how does it stack up in terms of cost, coverage, and customer experience? In this comprehensive review, we’ll explore the pros and cons of Nationwide Pet Insurance to help you determine if it’s the right fit for you and your furry (or feathered, or scaly) companion.

Overview of Nationwide Pet Insurance

Types of Coverage

Nationwide offers three main types of pet insurance plans:

- Whole Pet with Wellness: This is the most comprehensive plan available, covering accidents, illnesses, hereditary conditions, wellness visits, vaccinations, and even alternative therapies like acupuncture.

- Major Medical: A more basic plan that covers accidents and illnesses but does not include routine care.

- Pet Wellness: This plan is for routine care expenses such as vaccinations, flea prevention, and annual exams. It can be added to another policy for extra coverage.

One of the standout features of Nationwide is its exotic pet coverage, a rarity in the pet insurance industry. If you own a bird, rabbit, reptile, or other small mammal, Nationwide is one of the only providers that offer coverage.

Customer Experience and Claims Process

Who Should Consider Nationwide Pet Insurance?

- Exotic Pet Owners: If you have a bird, reptile, or small mammal, Nationwide is one of the only insurers that offer coverage for them.

- Multi-Pet Households: The multi-pet discount can make Nationwide an attractive option for families with multiple pets.

- Pet Owners Looking for Comprehensive Coverage: If you want accident, illness, and wellness care all in one plan, the Whole Pet with Wellness plan is a strong choice.

What is not included

Pre-existing Conditions

Any illness or injury that manifests before the start of coverage is considered a pre-existing condition and is generally not covered. However, if a condition is documented as cured for at least six months, it may become eligible for coverage.

Grooming and Routine Care

Services related to grooming, such as shampoos, baths, dips, and nail trims, are not covered under Nationwide’s plans. Routine and preventive care, including wellness exams, vaccinations, and flea or heartworm prevention, are also excluded unless a wellness plan is purchased separately.

Cruciate Ligament and Meniscal Injuries

Injuries to the cruciate ligament or meniscus occurring during the initial waiting period are excluded from coverage. Specific waiting periods may vary by state, so it’s essential to review individual policy details.

Congenital and Hereditary Disorders

Congenital anomalies (conditions present from birth) and developmental disorders are generally not covered unless they are neither visible nor symptomatic at the time of enrollment. Hereditary disorders, which are genetically transmitted conditions, have limited coverage under certain plans, such as the Major Medical plan.

Non-Veterinary Expenses

Expenses not directly related to veterinary services are excluded. This includes fees for waste disposal, taxes, record access or copying, and bank or credit card charges.

Behavioral Treatments and Alternative Therapies

Behavioral training, therapy, or treatment not prescribed by a veterinarian, as well as pet obedience training, are not covered. Additionally, alternative therapies and experimental treatments that are not within the standard veterinary care accepted by the state’s veterinary medical board are excluded.

Dietary Supplements and Special Diets

Foods, dietary, or nutritional supplements intended to maintain or improve general health, even if prescribed by a veterinarian, are not covered.

Specific Conditions

Certain conditions are explicitly excluded from coverage, including hip dysplasia, elbow dysplasia, osteochondritis dissecans, aseptic necrosis of the femoral head, cervical vertebral instability (wobbler syndrome), patellar luxation, renal dysplasia, cystine or urate urolithiasis, collapsed trachea, various ocular conditions (such as prolapsed gland of the third eyelid, entropion, and primary glaucoma), and blood disorders like hemophilia and von Willebrand’s disease.

Policyholders are encouraged to review their specific policy documents, including the Declarations Page or Renewal Certificate, for a comprehensive list of exclusions and any additional conditions that may apply. Understanding these exclusions ensures informed decisions regarding pet healthcare and insurance coverage.

How Does Nationwide Compare to Other Pet Insurance Providers?

When compared to competitors such as Healthy Paws, Embrace, and Trupanion, Nationwide stands out primarily for its exotic pet coverage. However, it falls short in terms of reimbursement rates and waiting periods. If you’re looking for higher reimbursement rates and faster claim processing, providers like Healthy Paws may be a better fit. If you need customizable wellness coverage, Embrace Pet Insurance is another good alternative.

Final Verdict: Is Nationwide Pet Insurance Worth It?

Overall, Nationwide Pet Insurance is a solid option for pet owners looking for comprehensive coverage, particularly those with exotic pets. While it may have longer claim processing times and slightly lower reimbursement rates, its wide range of coverage options and availability in all 50 states make it a competitive choice.

If you value comprehensive coverage and the ability to insure a wide range of pets, Nationwide is a great option. However, if fast claim processing and higher reimbursement percentages are your top priorities, you may want to explore other providers.

- Comprehensive Coverage Options

- Direct Vet Reimbursement Option

- Available in All 50 States

- Multi-Pet Discount

- Exotic Pet Coverage

- Lower Reimbursement Rates