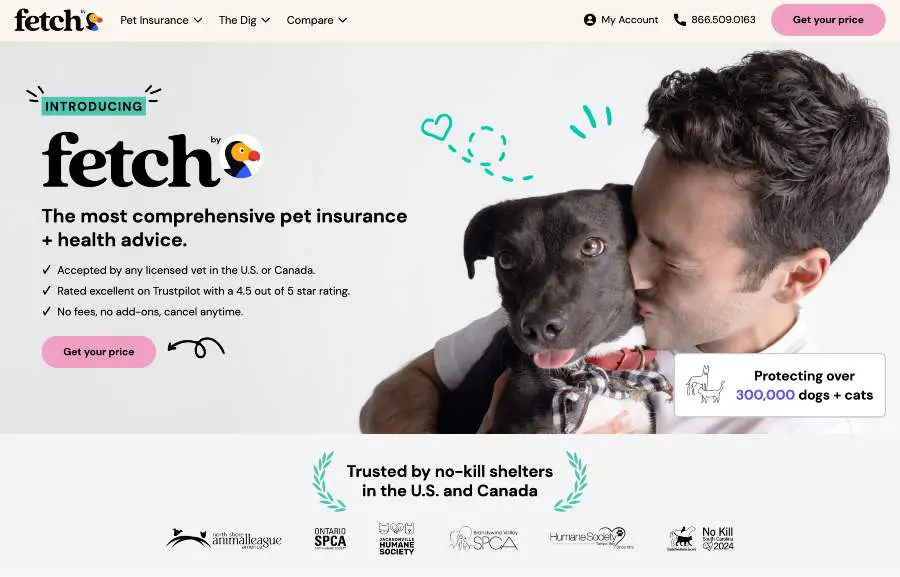

Fetch Pet Insurance Review (2025)

- What Coverage Options Does Fetch Pet Insurance Provide? Fetch offers extensive coverage for a variety of health issues, including accidents, illnesses, hereditary conditions, and cancer treatments. Additionally, they provide preventive care options and coverage for alternative therapies like acupuncture, ensuring comprehensive care for your pet.

- How Flexible and Affordable Are Fetch’s Insurance Plans? Fetch offers three main plans—Accident-Only, Complete, and Premium—designed to fit a range of needs and budgets. Whether you have a young, healthy pet or an older one with special needs, Fetch’s flexible plans make it easy to find the right fit.

- Is Fetch’s Claims Process Easy to Navigate? Fetch’s claims process is simple, allowing pet owners to submit claims through an online portal or mobile app for quick reimbursement. Most claims are processed within 7 to 10 business days, ensuring timely financial relief for veterinary bills.

- Why Should You Choose Fetch Pet Insurance for Your Pet? Fetch is ideal for pet owners seeking comprehensive and flexible coverage with options for preventive care and specialized treatments. Their transparent pricing, easy claims process, and excellent customer support make them a top choice for pet insurance.

Pet insurance has quickly become a necessity for pet owners looking to safeguard their furry companions from unforeseen medical expenses. Fetch Pet Insurance has emerged as a strong contender among the many providers offering pet coverage. Known for its comprehensive policies, flexible plans, and customer-focused approach, Fetch is rapidly gaining recognition in the world of pet insurance. But is Fetch the right choice for you and your pet? This in-depth review will explore the various aspects of Fetch Pet Insurance, including coverage options, pricing, claims process, and customer support, helping you determine whether it is the best provider for your needs.

Key Benefits of Fetch Pet Insurance

- Comprehensive Coverage: Fetch’s plans cover a wide range of medical issues, from routine veterinary visits to major surgeries. Whether it’s an emergency injury or ongoing treatment for a chronic condition, Fetch offers peace of mind for pet owners by covering the unexpected.

- Flexible Plans: Fetch recognizes that every pet owner’s needs are different. Whether you have a young, healthy pet or an older animal with pre-existing conditions, Fetch offers a selection of plans designed to meet those needs.

- Preventive Care Add-Ons: To make healthcare even more accessible, Fetch provides optional add-ons that focus on routine care and wellness. These add-ons help you save on preventive treatments, ensuring that your pet stays healthy year-round.

- Effortless Claims Process: Fetch provides an easy-to-navigate claims process. Pet owners can submit claims via the website or mobile app, making it a hassle-free experience.

- Advanced Treatments Covered: Fetch stands out by offering coverage for advanced treatments like cancer therapy and holistic options like acupuncture, which might not be included in other standard policies.

Coverage Options: What Does Fetch Cover?

Coverage for Accidents and Injuries

One of the core elements of Fetch’s coverage is its provision for accidents and injuries. Whether your pet suffers a sprain, a cut, or a more severe injury like a fracture, Fetch ensures that you won’t have to worry about the cost of emergency care. The Accident-Only Plan is ideal for pets that are generally healthy and unlikely to suffer from illnesses.

Illnesses and Chronic Conditions

Fetch also offers coverage for illnesses, ranging from common ailments like ear infections to more complex conditions such as diabetes, digestive issues, and kidney disease. Not only do these plans cover immediate treatment, but they also include long-term care for chronic conditions, which is especially important for older pets who may require ongoing treatment.

Hereditary and Congenital Conditions

Some pets, especially certain breeds, are more prone to hereditary and congenital disorders. Fetch provides coverage for these conditions, which is often excluded by other insurance providers. If you have a breed that is known to suffer from genetic conditions like hip dysplasia or heart disease, Fetch’s policy ensures that these issues won’t leave you financially burdened.

Cancer Treatments and Therapies

Cancer is one of the most challenging diagnoses a pet can face, and the costs of treatment can be astronomical. Fetch provides coverage for cancer treatments, including chemotherapy and radiation, which can help alleviate the financial strain when your pet needs intensive care. This includes coverage for alternative therapies such as acupuncture and hydrotherapy, which may complement traditional treatments and help with recovery.

Preventive Care Options

In addition to treating injuries and illnesses, Fetch offers preventive care add-ons that can help keep your pet in top health. These options cover routine exams, vaccinations, and dental cleanings, among other preventive treatments. By taking proactive steps to keep your pet healthy, you can avoid more serious health issues down the line.

Fetch’s Plans and Pricing: Tailored to Your Needs

1. Accident-Only Plan

The Accident-Only Plan is ideal for pet owners who have young, healthy pets with minimal risk of illness. This plan covers accidents, injuries, and emergency care, making it a cost-effective option for pets that do not require ongoing medical attention.

2. Complete Plan

The Complete Plan provides more comprehensive coverage by including not only accidents and injuries but also illnesses, hereditary conditions, and congenital disorders. This plan is perfect for pet owners who want well-rounded coverage that can protect their pets from a variety of medical issues.

3. Premium Plan

For pet owners who want the most extensive coverage, the Premium Plan offers everything in the Complete Plan, plus additional benefits like coverage for advanced treatments (such as cancer therapies) and higher reimbursement limits. This plan is designed for those who want peace of mind and financial protection in the event of significant medical issues.

Pricing Considerations: How Much Does Fetch Pet Insurance Cost?

In general, Fetch is competitively priced, and pet owners can choose from a variety of plan options to suit their financial situation. Whether you’re looking for basic coverage or a premium plan, Fetch offers a range of options to accommodate different budgets.

Claims Process and Reimbursements: Quick and Easy

One of the standout features of Fetch Pet Insurance is its simple and efficient claims process. Filing a claim with Fetch is straightforward, making it easier for pet owners to get reimbursed for their vet bills.

How to File a Claim with Fetch

- Log into Your Account: Access your online portal or mobile app.

- Submit Your Vet Bill: Upload a copy of your vet bill and include any additional details about the treatment your pet received.

- Wait for Review: Once submitted, your claim will be reviewed by the Fetch team. Most claims are processed within 7 to 10 business days.

Reimbursement Options

Fetch reimburses pet owners through direct deposit, which ensures quick access to your reimbursement funds. Depending on your plan, Fetch will cover between 70% and 90% of your vet bill, allowing you to customize your claim benefits according to your financial needs. This flexibility helps make pet care more affordable for a wide range of pet owners.

Customer Support: Excellent Assistance When You Need It Most

Fetch Pet Insurance places a strong emphasis on customer service. Their customer support team is accessible through various channels, including phone, email, and live chat, ensuring that help is available whenever you need it. For Spanish-speaking customers, Fetch also provides multilingual support.

Additionally, Fetch offers a comprehensive FAQ section and educational materials that empower pet owners to make informed decisions about their pet’s health. The availability of a dedicated claims team ensures that any issues or questions are addressed promptly.

Why Choose Fetch Pet Insurance?

Fetch Pet Insurance stands out for its comprehensive coverage options, flexible plans, and customer-centric service. Whether you’re seeking basic protection for a healthy young pet or advanced coverage for a senior pet with special needs, Fetch provides reliable and affordable solutions. The inclusion of preventive care add-ons and alternative therapies further sets Fetch apart, making it an appealing option for pet owners who want to ensure their pets receive the best possible care.

Who Should Consider Fetch Pet Insurance?

Fetch is ideal for pet owners who want advanced coverage for accidents, illnesses, and hereditary conditions. Pet owners who are interested in preventive care or seeking coverage for specialized therapies will find Fetch’s offerings particularly beneficial.

Additionally, Fetch is well-suited for those who want an insurance provider that is transparent, easy to work with, and committed to helping pets lead happy, healthy lives.

Conclusion: Is Fetch Pet Insurance Right for You?

Ultimately, Fetch Pet Insurance offers a solid combination of coverage, pricing, and customer support, making it an excellent choice for a wide range of pet owners. By choosing Fetch, you can ensure that your furry friend has access to the care they need, whether it’s for a routine visit or a more serious medical issue. The ability to customize plans and the inclusion of preventive care add-ons make Fetch a standout choice in the world of pet insurance.

To get started with Fetch, visit their website and get a personalized quote for your pet today. Investing in pet insurance can provide both peace of mind and financial protection, ensuring that your pet receives the best care throughout their lifetime.

- Most Comprehensive Pet Insurance

- Get back up to 90% on unexpected vet bills

- $1000 in online vet visits included for free

- Optional coverage for routine and preventive care

- Use any licensed vet in the U.S. or Canada

- Protecting 400,000+ dogs & cats

- Exam fees & hereditary conditions are covered

- Dental coverage for every adult tooth

- It offers only one plan

- Its coverage excludes preventive care